Table of Contents

The Philosophical Underpinnings of Saving

The Economic Reality of Today’s World

Understanding Your Spending: The Bedrock of Saving

Simple Money-Saving Tips for Beginners

Advanced Strategies for the Adept Saver

Final Thoughts on the Monetary Expedition

In the modern financial landscape, a grasp of prudent monetary practices is indispensable. Just as one would not venture into a foreign land without a map, nor should one navigate the vast realm of personal finance without a guide. This article, akin to a scholarly lecture, presents a comprehensive exploration of the subject. The aim here is to elucidate the essentials of money-saving, tailored especially for those at the dawn of their financial journey.

1. The Philosophical Underpinnings of Saving

It has been observed that saving money isn’t merely an act but a mindset. One must ask, “Why does one choose to save?” The answers, deeply entrenched in our evolutionary biology and societal constructs, reflect our innate desire for security and prosperity. Just as the squirrel stores nuts for winter, humans, driven by a similar foresight, allocate resources for the unforeseen.

2. The Economic Reality of Today’s World

In today’s global economy, characterized by volatile markets and unpredictable employment landscapes, the urgency to save has never been more palpable. It is said that, for the modern individual, the buffer between financial stability and ruin is a mere three paychecks. This reality underscores the importance of this beginner’s guide to saving money.

3. Understanding Your Spending: The Bedrock of Saving

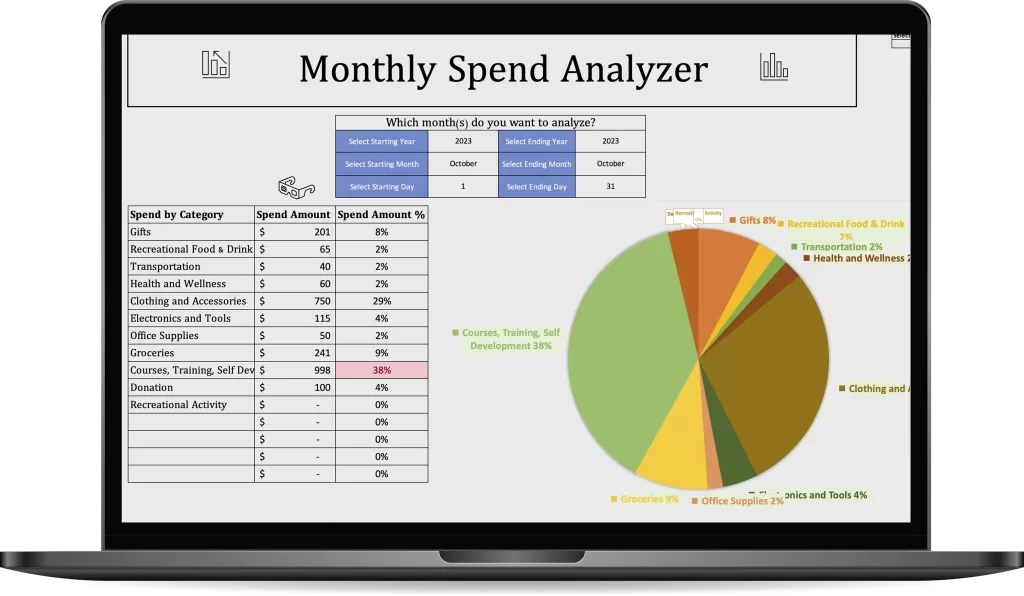

Before one embarks on the path of saving, a keen understanding of one’s own spending habits is paramount. For it has been noted by financial scholars that without awareness of where the money flows, strategies to stem wasteful expenditure prove futile.

One might ponder, “How best to achieve this cognizance?” The answer lies in meticulous tracking. And for those who might find this task daunting, tools have been fashioned to facilitate the process.

A Simple Expense Tracker can help immensely – a digital ledger, designed meticulously to capture every pecuniary detail. This tool, available for immediate download, simplifies the complex web of daily transactions into comprehensible data. Through its interactive interface, one can observe patterns, discern wasteful habits, and thus make informed decisions.

The use of such a tool, combined with a genuine desire to understand, provides a sturdy foundation upon which the edifice of saving can be constructed.

4. Simple Money-Saving Tips for Beginners

For those embarking on this journey, certain strategies have been identified as particularly beneficial. Presented below are some of these money-saving tips for beginners:

- Frugality as a Virtue: It is advised that one should not equate frugality with deprivation. Instead, view it as a testament to one’s discipline and foresight.

- Budgeting: A practice as ancient as civilization itself, budgeting remains the cornerstone of sound financial planning. By delineating one’s income and expenditures, a clearer path towards saving is charted.

- Avoiding Impulse Purchases: In a world brimming with consumerist temptations, restraint is deemed a virtue. It is recommended that before any significant purchase, a period of reflection be observed.

- Investing in Knowledge: The true value of education, particularly financial literacy, cannot be overstated. By arming oneself with knowledge, many financial pitfalls can be adroitly avoided.

5. Advanced Strategies for the Adept Saver

Once the foundational practices have been mastered, more nuanced strategies can be employed. These include:

- Diversifying Investments: The age-old adage, “Do not put all your eggs in one basket,” finds profound resonance here.

- Understanding Compound Interest: Often referred to as the ‘eighth wonder of the world,’ compound interest, when harnessed effectively, can be a formidable ally in the saving endeavor.

- Exploring Passive Income Streams: In the modern digital age, myriad opportunities for generating passive income have emerged. It is proposed that one investigates these avenues with due diligence.

6. Final Thoughts on the Monetary Expedition

In concluding this discourse on the beginner’s guide to saving money, it is hoped that the reader has gained not just practical strategies, but a deeper appreciation for the philosophy of saving. Like any expedition, the journey towards financial security is fraught with challenges. Yet, armed with knowledge and discipline, the path becomes clearer, and the destination ever more attainable.

May this guide serve as a trusted companion in your journey to save more money and become financially literate!

0 Comments